About This Simulation

Your Role

Sales Account Executive at

Navla

Your Goal

Your Mission

You solve marketing data challenges for a major enterprise client.

Simulation Details

Navla is a leading MarTech agency specializing in managing marketing data and analytics for enterprise clients. Over the past five years, Navla has successfully completed over 150 GA4 migrations, resulting in an average 25% improvement in marketing performance for their clients. For example, Navla’s GA4 migration for a leading retail chain resulted in a 30% increase in data accuracy and a 20% boost in marketing ROI. Additionally, Navla’s development of a first-party data strategy for a global e-commerce company led to a 15% increase in customer engagement and a 10% rise in conversion rates.

Navla employs a range of advanced tools and software to execute its services, including Google Analytics, Adobe Analytics, and custom data integration platforms. These tools enable Navla to provide precise and actionable insights, helping clients optimize their marketing efforts. For instance, their use of custom data integration platforms has allowed clients to consolidate data from multiple sources, reducing data silos and improving reporting accuracy by up to 20%.

The MarTech industry is currently undergoing significant changes, driven by new data privacy regulations such as GDPR and CCPA, and the increasing importance of first-party data in marketing strategies. Navla is at the forefront of these trends, offering innovative solutions to help clients navigate these challenges. Navla’s compliance solutions have helped clients like Mediolanum Bank ensure adherence to GDPR, reducing the risk of data breaches and associated fines.

Navla’s key clients include major enterprises such as Mediolanum Bank, where Navla’s solutions have been instrumental in overcoming marketing data challenges. Notable projects include a comprehensive GA4 migration for the bank, which resulted in a 30% increase in data accuracy and a 15% improvement in conversion rates. Navla’s client-centric approach ensures that they work closely with clients to understand their unique needs and deliver solutions that drive tangible results.

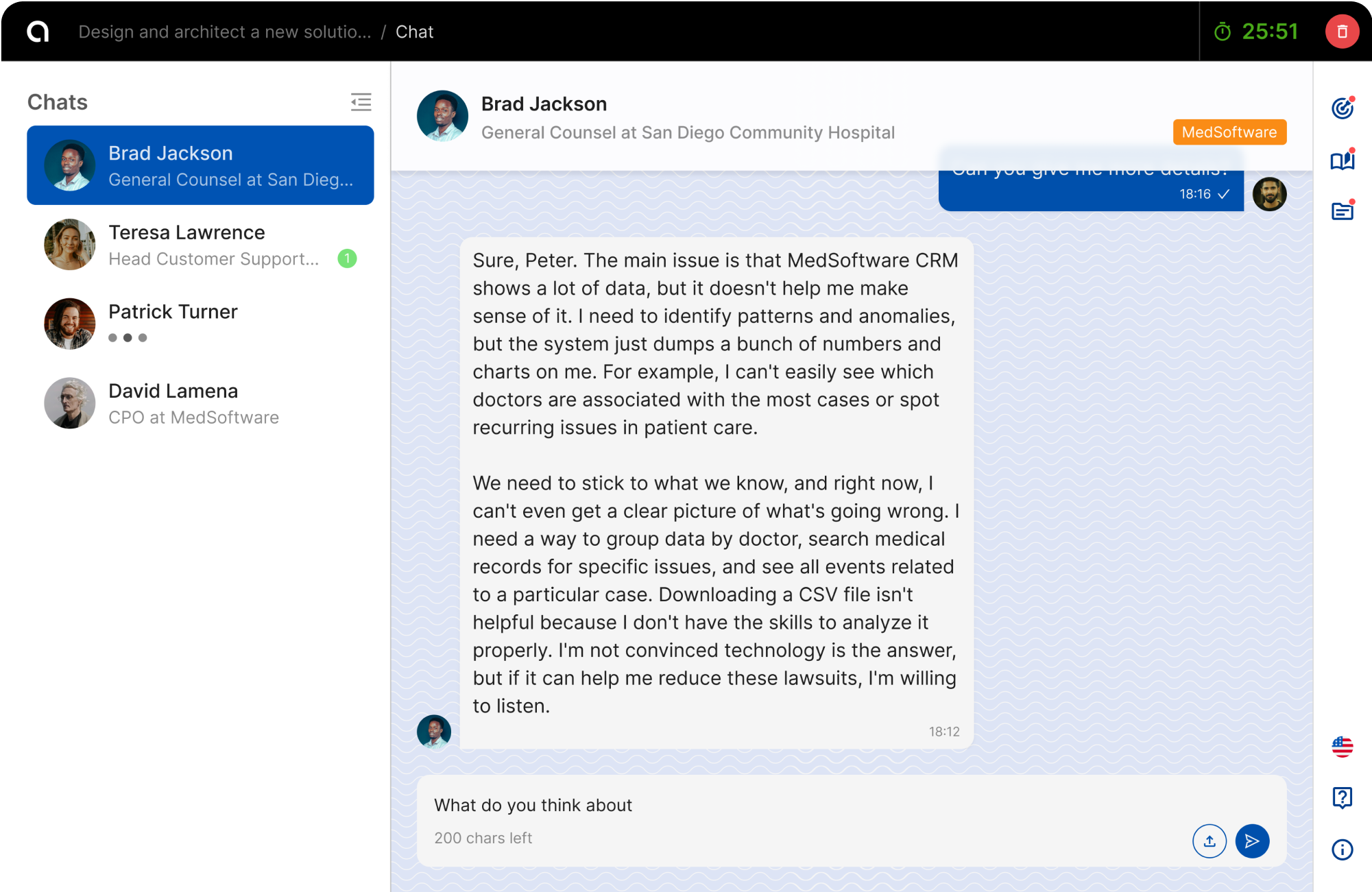

Mediolanum Bank is currently grappling with significant issues in their marketing data infrastructure, particularly with the migration to GA4 and the integration of marketing data across various platforms. They are facing challenges such as data discrepancies of up to 20% in their monthly reports, loss of historical data spanning over five years due to improper data migration protocols, and difficulties in tracking user behavior across multiple channels. These issues have led to a 15% drop in conversion rates and a 10% increase in customer acquisition costs over the past six months.

They are using a combination of legacy systems and modern tools, including Google Analytics (Universal Analytics), Adobe Analytics, and several in-house data management solutions. However, these systems are not fully integrated, leading to data silos and inconsistencies.

Mediolanum Bank is currently struggling to achieve key performance indicators (KPIs) such as improving conversion rates by 20%, reducing customer acquisition costs by 15%, and enhancing data accuracy to within a 5% discrepancy margin.

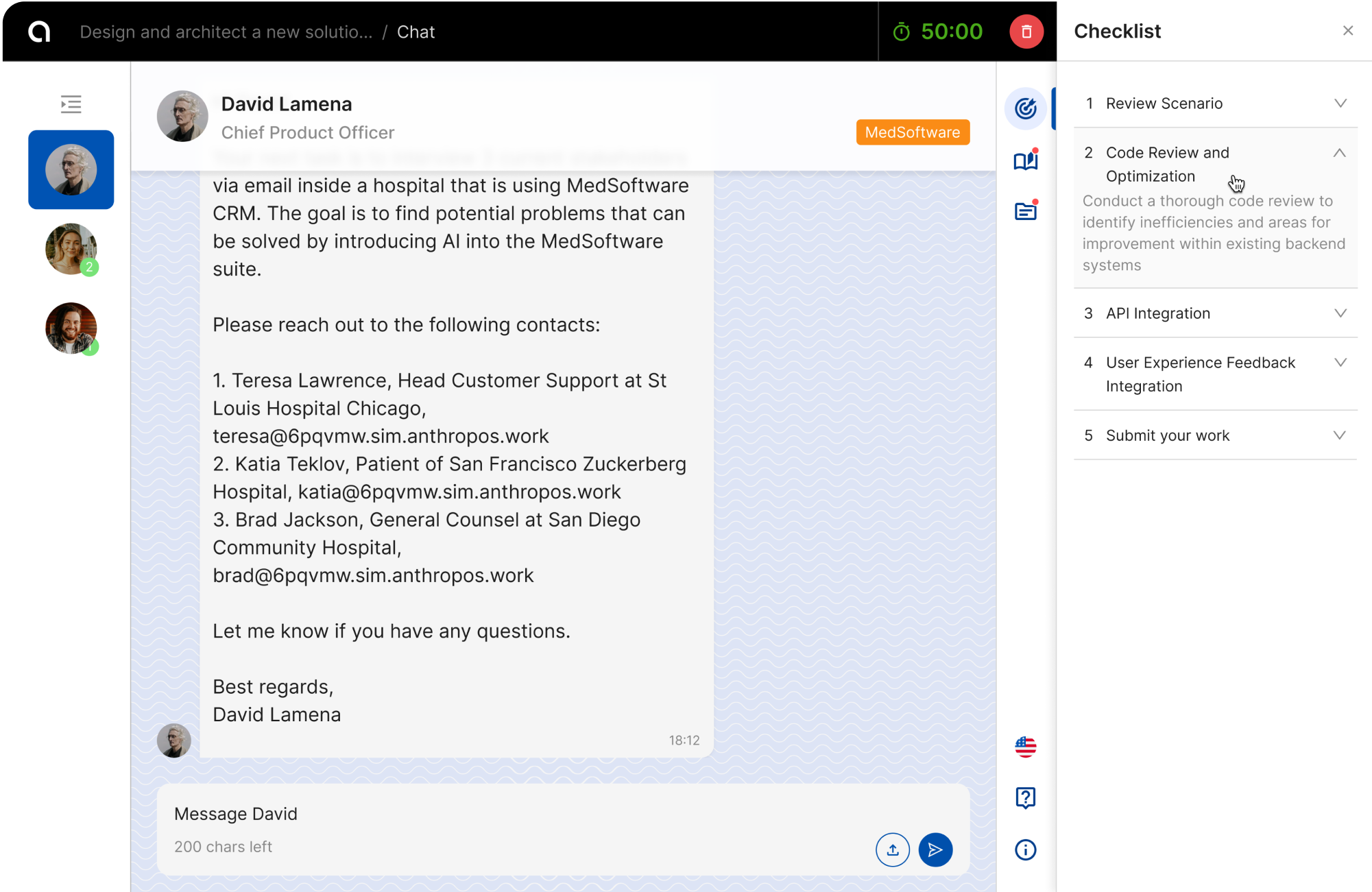

Navla’s internal processes for handling such challenges involve a collaborative approach between the Head of Delivery and the Head of Analytics. Marco Bianchi, the Head of Delivery, and Giulia Romano, the Head of Data Analytics, typically start by conducting a thorough assessment of the client’s existing data infrastructure, including a detailed review of their current analytics tools and data management practices. They identify key pain points such as data silos and integration gaps and gather detailed requirements from the client through workshops and interviews.

As a Sales Account Executive at Navla, your mission is to initiate contact with Alessandra Bernini, the CMO of Mediolanum Bank. You need to break the ice and convince her of Navla’s ability to help with her challenges. Following this, you will collaborate individually with Navla’s Head of Delivery and Head of Analytics to gather detailed information about Mediolanum Bank’s needs. Finally, you will develop a tailored proposal that addresses the identified challenges and demonstrates Navla’s value. Each decision you make will impact the project’s success, and your ability to navigate these tasks effectively will determine the outcome of the simulation.

1. Initiate a conversation with Alessandra Bernini to understand her marketing data challenges.

2. Collaborate with Marco Bianchi and Giulia Romano to gather detailed information about Mediolanum Bank’s needs.

3. Develop a tailored proposal that addresses Mediolanum Bank’s challenges and demonstrates Navla’s value.

Once you complete all the tasks, save the required final document in a PDF or DOCX and send it to Laura Conti.

Team

Who you will work with in this Simulation

Your team is 100% generated by AI – you will not interact with real people and no human will read your conversation.

CMO of Mediolanum Bank

Head of Delivery at Navla

Head of Data Analytics at Navla

Sales Account Executive at Navla

Sales Director at Navla

Organization

A leading MarTech agency specializing in managing marketing data and analytics for enterprise clients.

Helpful for

Sales Account Executive, Business Development Manager, Client Relationship Manager

AI Simulations

Experience the Adventure

AI Simulations

Instant Results, Real Rewards