About This Simulation

Your Role

Junior Multifamily Investment Associate at

Harverton Real Estate Partners

Your Goal

Your Mission

You address a property owner’s concerns to qualify a lead.

Simulation Details

Harverton Real Estate Partners is a multifamily real estate investment firm specializing in sourcing, acquiring, and managing residential properties designed for multiple families. Operating in urban areas with growing populations, particularly in the Midwest and Southeast United States, the firm uses demographic analysis to identify high-potential markets. With a proven track record of acquiring over 50 multifamily properties valued at $200 million, Harverton collaborates with property management firms and local real estate agents to ensure success. Notable acquisitions include the “Parkview Residences” in Chicago, achieving a 95% occupancy rate within six months, and the “Lakeside Apartments” in Atlanta, generating a 12% annual cash-on-cash return for investors.

Harverton leverages proprietary algorithms to analyze occupancy rates, tenant turnover, and neighborhood growth potential, prioritizing properties with occupancy rates above 90% and annual cash flow exceeding $100,000. The firm uses Salesforce CRM for lead management and CoStar Analytics for market research, enabling data-driven decision-making. Harverton emphasizes professional development through mentorship programs, workshops, and coaching sessions, preparing associates to navigate challenges such as tenant displacement concerns, tax implications, and skepticism from property owners.

You will step into the role of Alex, a Junior Multifamily Investment Associate at Harverton Real Estate Partners. Your mission is to conduct a cold call with Cameron Reyes, a seasoned and skeptical property owner, to discuss the potential sale of his multifamily complex. Cameron is protective of his property and wary of unsolicited offers, with concerns about tenant displacement, tax implications, and Harverton’s ability to manage the property effectively.

Your goal is to establish credibility, address Cameron’s objections, and uncover his motivations, such as reducing management burdens or exploring portfolio diversification. Using active listening, negotiation, and objection-handling skills, you must navigate the conversation with professionalism and empathy. Success hinges on leaving a positive impression, qualifying the lead for future discussions, and gathering useful insights about the property.

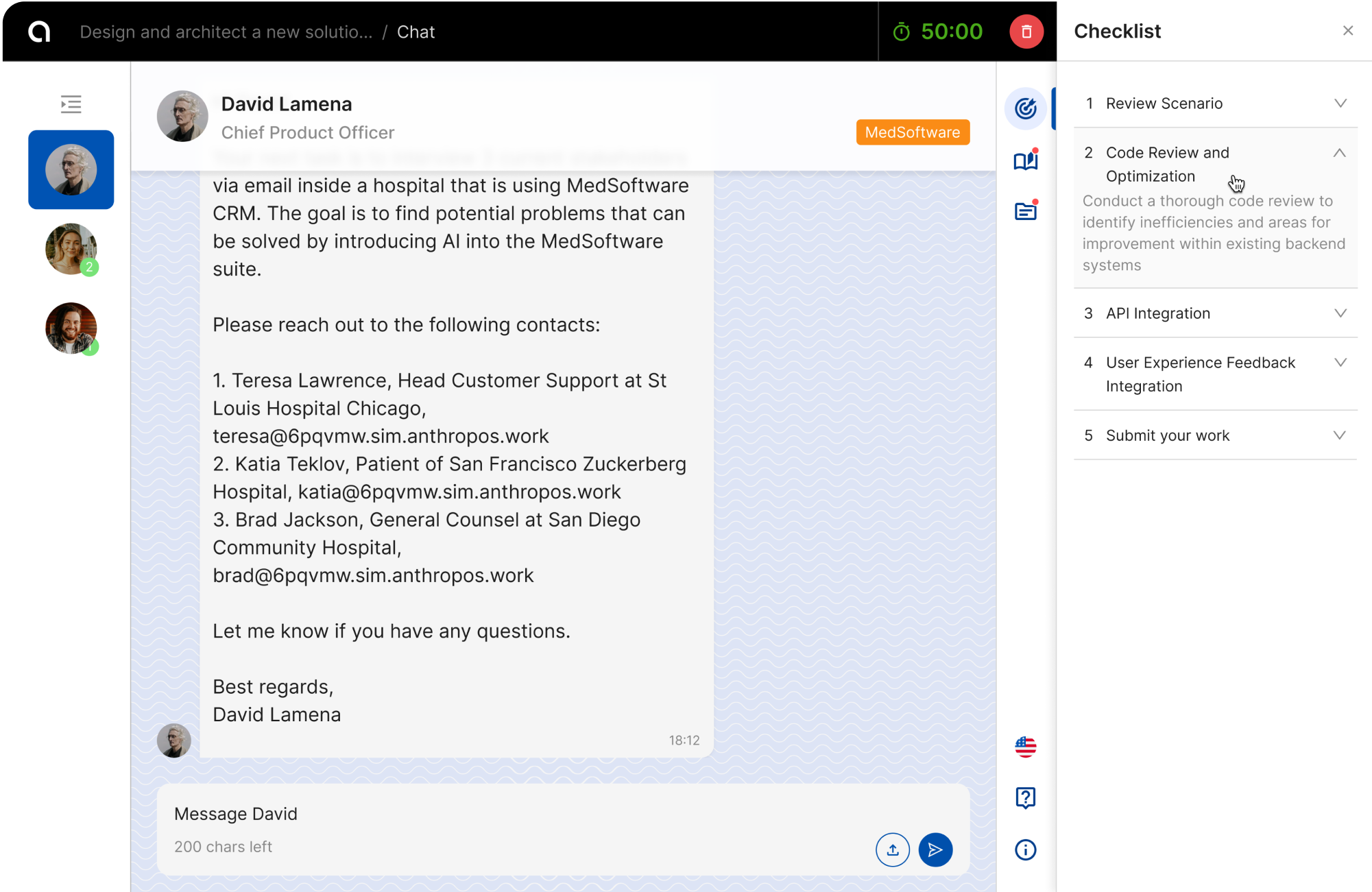

– Engage in a real-time chat with Cameron Reyes to discuss his property.

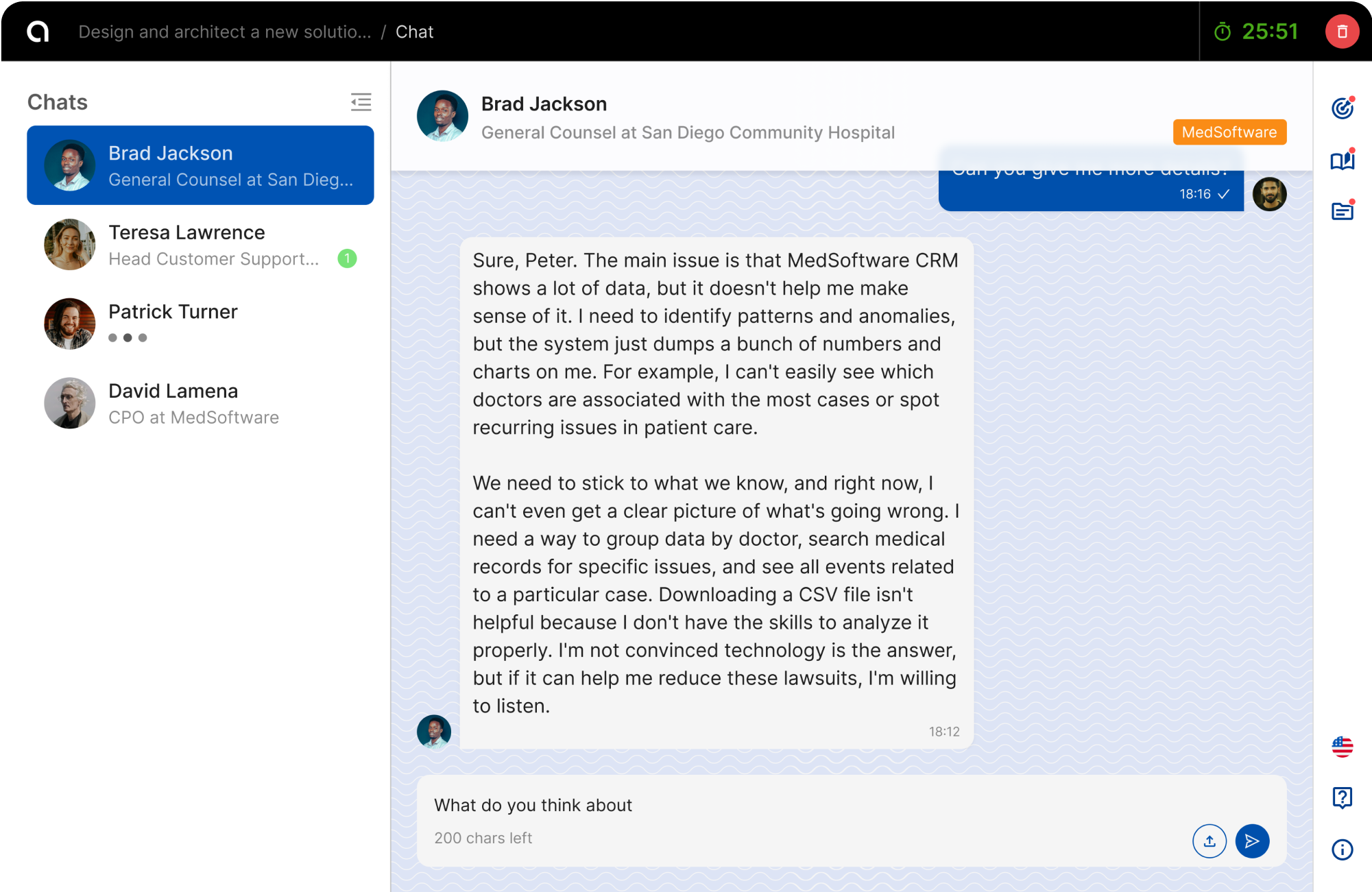

– Address Cameron’s objections about tenant displacement, tax implications, and Harverton’s credibility.

– Ask targeted questions to uncover Cameron’s motivations and priorities.

– Build trust and rapport through active listening and professional communication.

– Gather actionable insights about the property to qualify the lead for potential future collaboration.

Team

Who you will work with in this Simulation

Your team is 100% generated by AI – you will not interact with real people and no human will read your conversation.

Junior Multifamily Investment Associate

Multifamily Property Owner

Organization

A multifamily real estate investment firm specializing in sourcing, acquiring, and managing residential properties designed for multiple families.

Helpful for

Junior Multifamily Investment Associate, Real Estate Analyst, Sales Representative

AI Simulations

Experience the Adventure

AI Simulations

Instant Results, Real Rewards