About This Simulation

Your Role

Head of Insurance at

Faculty

Your Goal

Your Mission

You align Faculty’s AI solutions with insurance market needs.

Simulation Details

Faculty is a leading AI-focused organization dedicated to enhancing organizational performance through safe, impactful, and human-centric AI solutions. With over a decade of experience, Faculty has partnered with over 300 global customers, including major insurance firms like Aviva and Allianz, to deliver measurable outcomes such as a 40% improvement in operational efficiency and a 25% increase in customer satisfaction. Faculty’s AI-driven tools integrate seamlessly into existing systems, minimizing disruption while achieving transformative results. Notable achievements include reducing claims processing time by 60%, improving fraud detection accuracy to 95%, and reducing underwriting risks by 30%. Faculty’s commitment to ethical AI practices and collaboration with regulatory bodies ensures compliance with GDPR and other standards, fostering trust and reliability in the insurance sector.

In this simulation, you step into the role of Alex Morgan, the newly appointed Head of Insurance at Faculty. Your mission is to craft a strategic insurance market positioning plan that aligns Faculty’s AI solutions with the needs of the insurance sector while addressing regulatory compliance and competitive pressures.

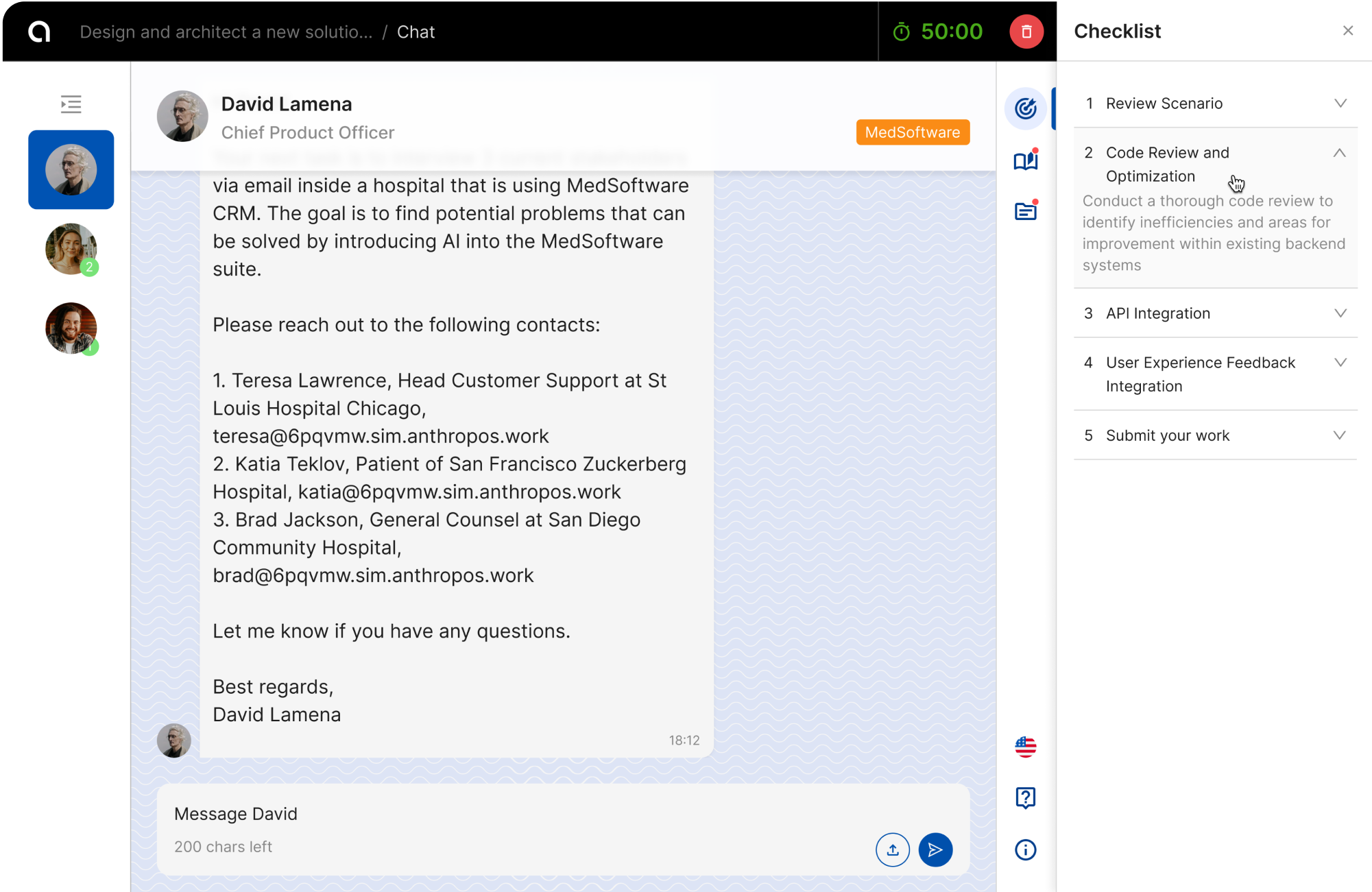

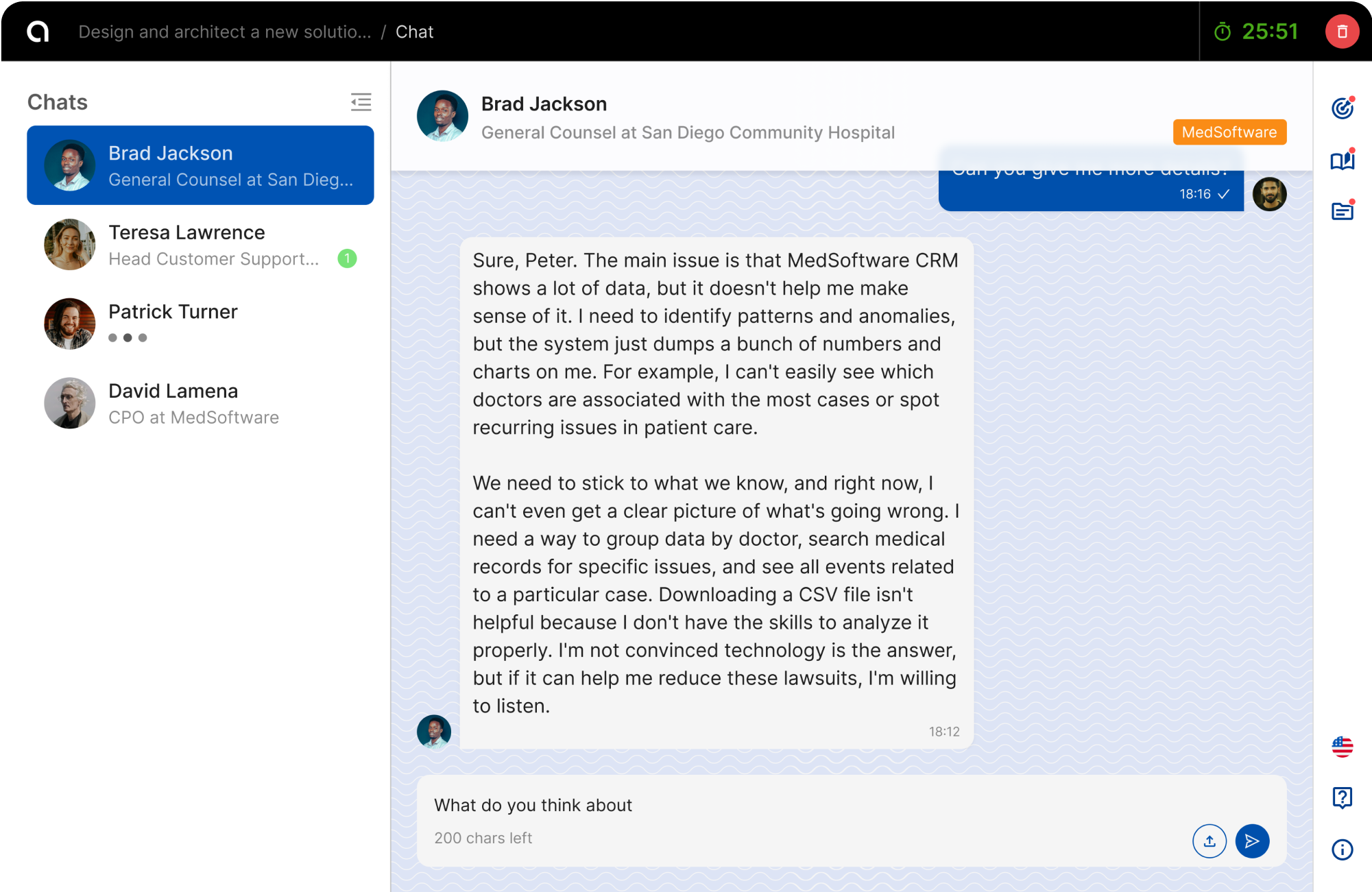

You will engage in real-time, one-on-one conversations with key stakeholders to gather insights, refine strategies, and make critical decisions. These stakeholders include Eleanor Whitaker, the Director of Financial Services, who will provide guidance on aligning strategies with Faculty’s mission and compliance standards; Rajesh Kapoor, a Senior Executive from a major insurance firm, who will share industry-specific challenges and expectations; and Jonathan Hayes, the Vice President of Business Development, who will evaluate the feasibility and growth potential of your proposed strategies.

Your objectives include developing innovative client propositions that leverage Faculty’s AI capabilities to address industry challenges such as operational inefficiencies, customer trust issues, and regulatory compliance. Additionally, you must identify and propose a strategic partnership with a firm that complements Faculty’s strengths, amplifies its market presence, and drives revenue growth. Success means delivering actionable strategies that align with Faculty’s broader business objectives and establish the company as a trusted leader in the insurance market.

– Engage in real-time conversations with Eleanor Whitaker to ensure alignment with Faculty’s mission and compliance standards.

– Discuss industry challenges and expectations with Rajesh Kapoor to refine your client propositions and partnership ideas.

– Present your strategic plan to Jonathan Hayes, focusing on actionable strategies that drive growth and differentiate Faculty from competitors.

– Demonstrate how Faculty’s AI solutions adhere to regulatory standards and address customer trust issues effectively.

– Highlight Faculty’s proven achievements and position its offerings as superior to competitors.

Team

Who you will work with in this Simulation

Your team is 100% generated by AI – you will not interact with real people and no human will read your conversation.

Director of Financial Services

Senior Executive, Insurance Strategy

Head of Insurance

Vice President of Business Development

Organization

A pioneering AI-focused organization dedicated to transforming organizational performance through safe, impactful, and human-centric AI solutions.

Helpful for

Head of Insurance, Business Development Manager, Insurance Strategy Consultant

AI Simulations

Experience the Adventure

AI Simulations

Instant Results, Real Rewards