About This Simulation

Your Role

Support Specialist at

Covermore

Your Goal

Your Mission

You resolve insurance issues and mentor a junior colleague.

Simulation Details

Covermore, a subsidiary of the Zurich Group, is a global leader in travel insurance, serving over 15 million customers annually across 14 countries. The company specializes in tailored insurance solutions, including coverage for pre-existing medical conditions, trip cancellations, and medical emergencies. Covermore’s proprietary insurance management system automates policy adjustments, ensures compliance, and resolves issues efficiently, with an average resolution time of 48 hours. This system prioritizes urgent cases during peak travel seasons, ensuring timely resolutions for imminent departures. Covermore also employs cutting-edge tools like AI-driven analytics integrated with real-time chat software, enabling support specialists to handle high-pressure situations with precision and empathy. The company’s commitment to excellence is demonstrated through its 99% success rate in compliance audits and its ability to adapt to industry changes, such as introducing innovative policy options during the COVID-19 pandemic. Continuous training ensures specialists are equipped to navigate complex regulatory scenarios and deliver empathetic service.

Step into the role of Alex Morgan, an experienced Support Specialist at Covermore, tasked with resolving a high-stakes customer issue while mentoring a new coworker. Your mission involves two key objectives:

1. Resolve Mark’s Policy Issue: Engage in a one-on-one chat with Mark Tennyson, a frustrated customer facing urgent travel insurance concerns. Empathize with his frustrations, correct the travel dates in his policy, and clarify coverage specifics for pre-existing medical conditions. Ensure compliance with regulatory standards while providing clear and reassuring communication.

2. Mentor Jade on Policy Protocols: In a separate one-on-one chat, guide Jade Nakamura, a junior customer support representative, through the steps taken to resolve Mark’s issue. Explain policy correction processes, highlight compliance requirements, and demonstrate empathetic communication strategies. Provide constructive feedback to help Jade build confidence and prepare for future complex cases.

Your ability to balance technical accuracy with empathetic communication will be evaluated as you work to satisfy Mark’s concerns and support Jade’s professional growth.

– Successfully resolve Mark’s travel insurance issue by correcting his policy details and addressing his concerns with empathy and precision.

– Provide Jade with a clear explanation of the steps taken to resolve Mark’s issue, emphasizing compliance requirements and best practices.

– Offer constructive feedback to Jade to boost her confidence and understanding of handling complex customer scenarios.

Once you have completed all the tasks, save the required final document in a PDF or DOCX and send it to Olivia Carter for review.

Team

Who you will work with in this Simulation

Your team is 100% generated by AI – you will not interact with real people and no human will read your conversation.

Policyholder with Special Coverage Needs

Junior Customer Support Representative

Senior Customer Support Manager

Support Specialist

Organization

A global leader in the travel insurance industry, providing specialized insurance solutions tailored to diverse customer needs.

Helpful for

Support Specialist, Customer Service Representative, Compliance Officer

AI Simulations

Experience the Adventure

AI Simulations

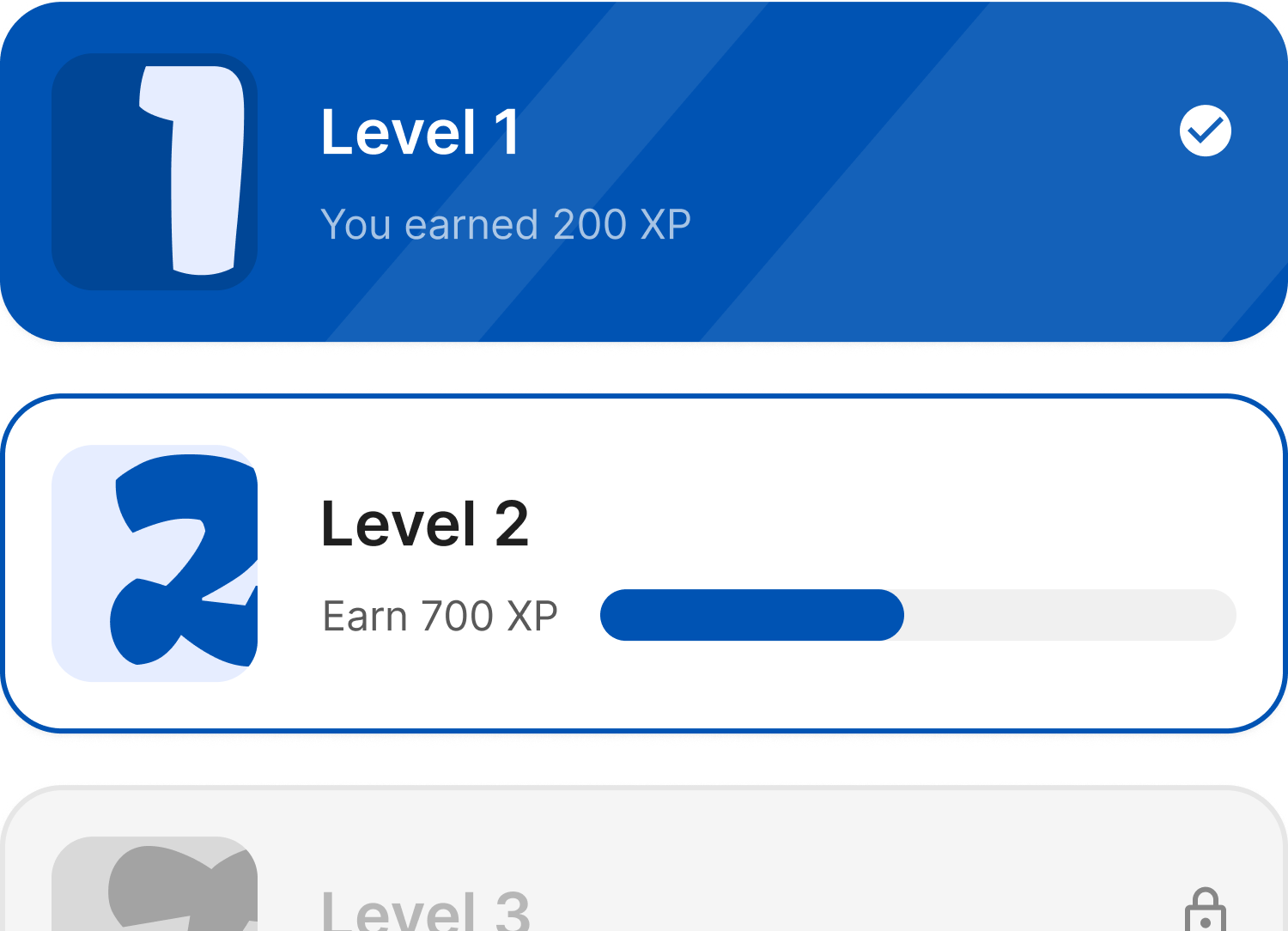

Instant Results, Real Rewards